Financial Advisor Victoria Bc - Questions

Table of ContentsThe Definitive Guide to Independent Investment Advisor copyrightWhat Does Independent Investment Advisor copyright Mean?Investment Representative for Dummies3 Simple Techniques For Independent Investment Advisor copyrightInvestment Representative Things To Know Before You Get ThisMore About Investment Consultant

“If you're to purchase an item, state a tv or a computer, you might would like to know the specifications of itwhat are its components and what it is capable of doing,” Purda details. “You can remember getting monetary information and assistance in the same manner. People have to know what they are buying.” With financial advice, it is vital that you just remember that , the item isn’t bonds, shares and other investments.It’s things such as cost management, planning for pension or reducing personal debt. And like buying some type of computer from a trusted company, consumers need to know they might be getting economic advice from a reliable pro. One of Purda and Ashworth’s best results is around the charges that financial planners charge their clients.

This conducted genuine it doesn't matter the charge structurehourly, fee, possessions under administration or predetermined fee (inside the study, the buck worth of charges ended up being equivalent in each instance). “It still boils down to the worth proposition and doubt on consumers’ component which they don’t understand what they truly are getting into change for those costs,” claims Purda.

Lighthouse Wealth Management - The Facts

Hear this short article as soon as you notice the definition of monetary consultant, just what pops into their heads? Many think of a specialist who can provide them with economic information, especially when you are considering spending. That’s a great starting point, however it doesn’t decorate the entire image. Not really near! Monetary analysts can people with a number of other money goals also.

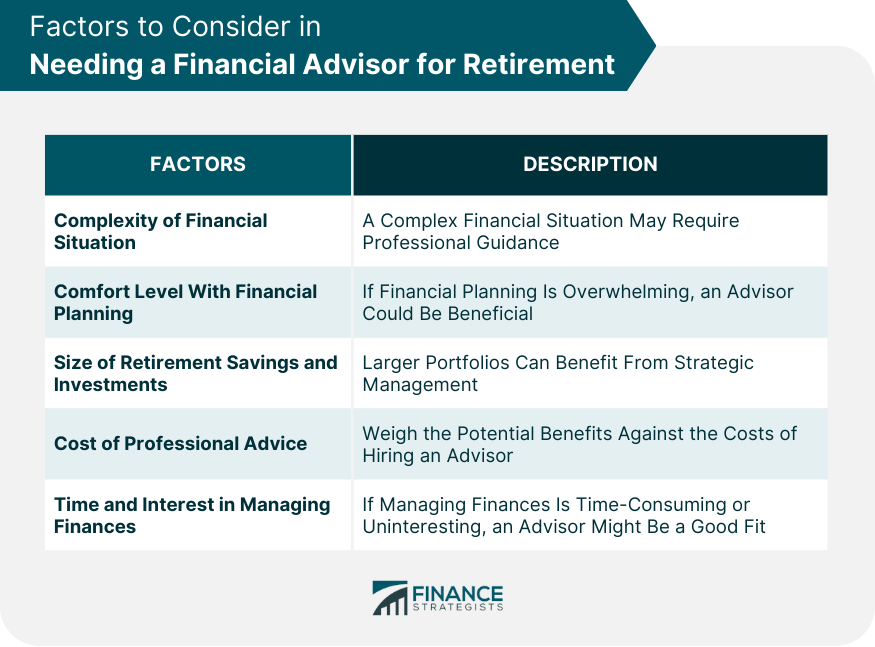

A monetary specialist will allow you to develop wealth and protect it for long-term. They can approximate your personal future economic needs and plan how to stretch the your retirement cost savings. They're able to additionally counsel you on when to begin experiencing personal safety and utilizing money within pension accounts to avoid any terrible charges.

Fascination About Retirement Planning copyright

They could let you ascertain just what shared resources are right for you and show you simple tips to manage while making one particular of the opportunities. They could in addition assist you to see the risks and what you’ll need to do to produce your aims. A seasoned investment pro can also help you stick to the roller coaster of investingeven if your opportunities take a dive.

They may be able provide assistance you'll want to produce a plan to help you be sure that desires are performed. And you can’t place a cost tag from the comfort that accompanies that. Based on a recent study, the average 65-year-old few in 2022 requires around $315,000 saved to cover healthcare expenses in your retirement.

The smart Trick of Ia Wealth Management That Nobody is Talking About

Since we’ve gone over what economic analysts perform, let’s dig into the a variety. Here’s an excellent rule of thumb: All economic planners tend to be monetary analysts, although not all experts tend to be coordinators - https://www.artstation.com/user-5327267/profile. A financial coordinator concentrates on assisting folks develop plans to reach long-lasting goalsthings like beginning a college fund or conserving for a down repayment on a home

So how do you know which economic expert suits you - https://padlet.com/carlosprycev8x5j2/lighthouse-wealth-management-a-division-of-ia-private-wealth-nb61uqub0429yw8i? Below are a few things you can do to be sure you are really choosing suitable individual. What now ? when you have two poor options to select from? Effortless! Find more options. The greater amount of choices you may have, the much more likely you happen to be in order to make an effective choice

The Single Strategy To Use For Investment Consultant

All of our Smart, Vestor program can make it possible for you by showing you as much as five monetary analysts who can serve you. The good thing is actually, it’s totally free for associated with an advisor! And don’t forget to come to the interview ready with a list of concerns to inquire about so you're able to decide if they’re a great fit.

But pay attention, even though an advisor is wiser than the average bear does not provide them with the authority to let you know how to proceed. Often, advisors are loaded with on their own because they convey more degrees than a thermometer. If an advisor starts talking-down for your requirements, it’s time and energy to demonstrate to them the doorway.

Keep in mind that! It’s essential that you as well as your financial consultant (whoever it winds up becoming) are on the exact same web page. Need a consultant who has a long-term investing strategysomeone who’ll motivate you to hold investing constantly whether the marketplace is up or down. tax planning copyright. You additionally don’t need to make use of someone that lighthouse wealth management pushes that invest in a thing that’s also high-risk or you’re not comfortable with

4 Easy Facts About Investment Representative Explained

That mix gives you the variation you'll want to effectively spend when it comes down to long haul. Whilst research economic advisors, you’ll most likely run into the term fiduciary task. All of this suggests is any advisor you employ has got to act in a fashion that benefits their own client and not their very own self-interest.